The Billion-Dollar Horizon: Why ₹1 Trillion by 2030?

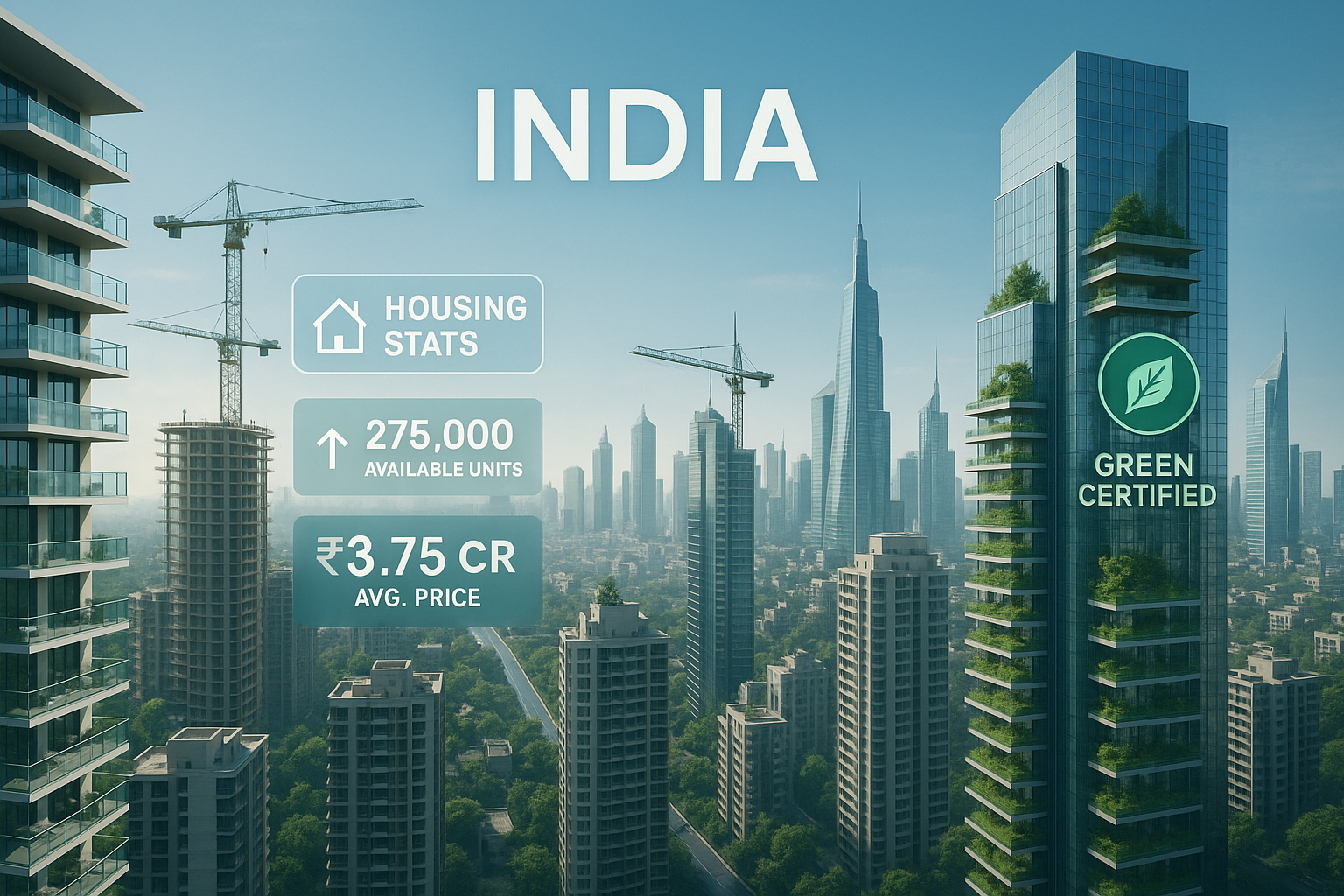

The Confederation of Real Estate Developers’ Associations of India (CREDAI), led by President Shekhar Patel, has dropped a bombshell: India’s real estate market is on track to hit a staggering $1 trillion (₹83 lakh crore) valuation by 2030.

That’s more than triple today’s size slated to grow from ₹24 lakh crore ($300 bn). And if CREDAI’s mid‑term forecast holds, we’ll see 7 crore new homes built by 2030, with nearly 87% priced above ₹45 lakh .

What’s Driving this Record Growth?

1. Economic Boom & Rising Incomes

India’s economy is speeding forward growing GDP and expanding middle-class incomes mean more people can finally afford homes.

2. Urbanization on Overdrive

Every month, hundreds of thousands of Indians move into cities. Every new IT park, highway, or metro line fuels fresh housing demand.

3. Medical & Education Hubs

Pune, Ahmedabad, Lucknow, Coimbatore they’re not just pretty names, they’re real estate success stories. People want quality living and good jobs.

4. Dream to 2047

Under the “Viksit Bharat 2047” vision, real estate is not just about property it’s the economic cornerstone of India’s development strategy.

What Kind of Homes Will Sell?

CREDAI predicts around 7 crore units will hit the market by 2030 with 13 crore buyers vying for homes. Not budget pads, but aspirational ₹45 lakh+ homes that deliver space, facilities, and green credentials.

Think compact 2‑3 BHKs in emerging urban hubs – modern, affordable, and aspirational.

Beyond Bricks: ESG & Sustainability Gain Ground

CREDAI isn’t just dreaming big on numbers it’s focusing on sustainability too. President Patel envisions carbon-neutral developments by 2050, reforestation initiatives, and skilling programs for 10 lakh workers.

Real estate will soon need green ratings, solar rooftops, and cleaned-up construction methods. This isn’t just good for the planet it’s good business.

What This Means for You: A 2025 Investment Roadmap

- Eye Emerging Cities

Tier-2 and Tier-3 cities are your golden ticket. They offer next-gen infrastructure, affordability, and massive upside. - Choose Aspirational Homes

With 87% demand in the ₹45 lakh+ segment, compact but high-quality homes promise quick appreciation. - Bet on Sustainability

ESG-compliant projects will fetch a resale premium and command tenant preference. - Track Policy Moves

Incentives under Smart Cities, PMAY, or eco-friendly mandates can shift market sentiment overnight.

Snapshot Table

| Sector Indicator | Today (2025) | 2030 Target | 2047 Vision |

|---|---|---|---|

| Market Size | ₹24 lakh cr (~$300 bn) | ₹83 lakh cr (~$1 trn) | ₹400 lakh cr (~$5 trn) |

| Housing Units (Additional) | N/A | 7 crore | TBD |

| Demand in ₹45 lakh+ Segment | 61% supply | 87% demand | – |

| Sustainability Commitment | Early-stage adoption | Carbon neutrality goal | Carbon-negative aim |

Final Word

CREDAI’s projection isn’t speculation it’s backed by data: booming incomes, expanding urban landscapes, and policy momentum. For anyone eyeing Indian real estate, 2030 offers a once-in-a-lifetime chance. Those smart enough to pick the right city, product, and sustainability-driven build will stay ahead.

Top FAQs

Q1: Is ₹1 trillion by 2030 realistic?

Yes – CREDAI links it to booming housing demand (7 cr homes) and rising income levels. With urban migration and aspirational buying, it’s not hype it’s happening.

Q2: Does the forecast apply to big metros or smaller cities too?

Smaller cities are where most growth will happen. Tier‑2/3 hubs offer space, policy benefits, and lower entry prices—read: strong potential.

Q3: How important is sustainability in upcoming projects?

Very. CREDAI’s push for carbon-neutral builds and green certifications will make eco-friendly homes the new standard.

Q4: What price range should buyers aim for?

Affordable luxury: homes ₹45 lakh and above, but still offering space and modern amenities households in that bracket are skyrocketing.

Q5: How should I invest – residential or mixed-use?

Residential in growth corridors is smart, but mixed-use projects (offices + homes + retail) near transit hubs offer higher diversification and yield.

This projection is not just a goal it’s a road map. And for Estate Brief readers, it’s your cue to think big, act now, and ride India’s next housing wave.